GST readiness- The software perspective

As of 1st May 2017 , we are two months away from the GST go-live date. The final rules and rates are still not final and the software is still not ready. GST is more than a tax change – it’s a business process change.

How can we use this short period to prepare our organizations to be GST compliant? In this blog, we discuss how a Tally.ERP 9 user can start preparing for GST even before having the GST enabled Tally.ERP 9 Edition.

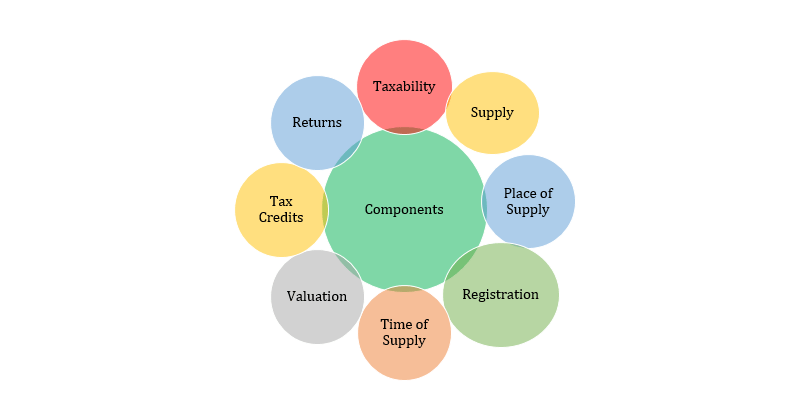

Key Components of GST

A good GST software would ensure that :

-

- You are able to quickly adapt to changing GST requirements and rules as they are announced.

-

- There are a minimum number of mismatched transactions between you and your Suppliers/Customers. That mismatches are easily communicated to the to the other party for quick resolution.

-

- You are able to ensure that all required entries have been included for compliance and that taxes are correctly paid.

- That any exceptions, exclusions or mistakes are easily identified before final GST returns uploaded.

There are three key areas to prepare for GST :

- Getting aware of the GST law. Understanding the implications to your business and planning the business changes that need to be made.

- Start making use of using currently available functionality in the existing release of Tally.ERP 9.

- Once the GST Enabled edition is available, you set up the new GST Enabled Tally.ERP 9 Edition and go live quickly.

You may be wondering how you can prepare for the software setup without the final GST Enabled Edition of Tally.ERP 9. However, there are already available features within Tally.ERP 9 that you will require to set up for GST. Why not set them up now and be ready for the final GST enabled edition?

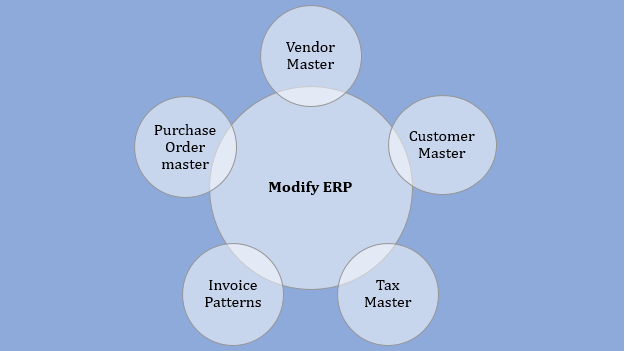

Key aspects to update/modify on your /ERP

Setup of masters & transactions :

For a smooth GST transition, the setup of Masters is most important. You should start working on this immediately in order to ensure readiness.

- Item Master : Some Tally.ERP 9 users do not currently use the Inventory functionality. Now is a good time to setup the inventory module, create items and familiarize yourself with how stocks are handled. You can setup Item Groups and Item Categories for easy tracking and also setup GST rates at an Item or Item Group level. You can also setup the Bill of Materials feature if you are a manufacturer. Many clients who use the inventory feature do not have a proper list of stock items. There are many duplicates which will create additional problems when you have to start mapping the HSN Code to the various items. Hence ensure that you take a good look at your Item master and clean it up if required.

Item pricing is another area to familiarize yourself with. In Tally.ERP 9 you can setup standard purchase and sales pricing. In addition you can setup different price levels eg. Dealer Price, Customer price etc. This would reduce the chances of making mistakes at the time of Sales/Purchase entry and lesser resultant mismatched once GSTN goes live.

Unutilized Input Tax Credit on Opening Stock as on 1st July 2017 will be an important number. Do ensure that you are tracking this as the quarter progresses.

- Godowns : Setup your Godowns/storage locations since GST requires that the inventory at each location needs to be tracked.

- Chart of Account Setup : Given the various reporting requirements, there could be some enhancements required to your chart of Accounts. Eg. B2B Customers, B2C Customers, Locations-wise Sales tracking etc. It would be a good idea to explore the functionality available in Tally.ERP 9 to create flexible chare of Accounts.

- Customer Master : Under GST, the place of supply is critical. A single customer may have multiple GST Registrations for each state and you may have to supply to different states for the same customer.

For each customer you should start collecting Contact Details ( to manage Invoice mismatches). It will ease your life if your software automatically sends SMS / Emails to customers for unmatched transactions. In addition Locations and GST Registration for each location, Payment Terms also need to be known and setup in Tally.ERP 9 for each customer. This is essential since Advances also have a GST impact and a Bill-by-Bill tracking of customers is required under GST.

As part of the GST Returns – you need to know which are your B2B, Ecommerce and and B2C transactions.

- Vendor Master : In addition to the info required for Customers, in case of Vendors you additionally need to collect the HSN Codes for items supplied to you. If Reverse Charge is to be applied then that too needs to be recorded.

- Tax Masters : You can start looking at the Tax Master feature in Tally to familiarize yourself with how VAT or Excise is currently being managed. Rates can be changed at Item or Group level – making it easy to make updates in Tally.ERP 9

- Voucher Numbering & Series : Tally.ERP 9 allows for multiple & user defined voucher numbering. Under GST law a user needs to maintain proper serial control of transactions for various different types of transactions and hence this can be setup now.

- Security options : Under the draft GST law, change logs need to be maintained . In any case, it’s a good idea to setup the Tally.ERP 9 security options. This can enable the organization to control who makes entries. Tally.ERP also had a Voucher Type Security option where a particular user is authorized to enter only certain types of transactions.

- Purchase & Sales Orders : It might be a good time to explore this functionality of Tally.ERP 9. When you issue a PO to your supplier, you are setting up a transaction approval mechanism where the Items, Location of supply, Taxes, Terms of Payment etc are approved by both Supplierand Customer. This will reduce mismatches since all the above transactions would have been agreed upon before the actual Sales or Purchase entry is made and uploaded on the GSTN .

- Stock Transfer Journal : Tally.ERP 9 also has a Stock Transfer Journal that enables transfer of items from one location to another. Such records are also mandatory under the GST law.

- Voucher Types in Tally.ERP 9 : Tally has a Voucher Type creation feature. Under GST you will need to keep track of various types of transactions eg. B2B , Ecommerce or B2C transactions for Outward Supplies . It will be essential that you enable and start using this feature.

- Bill-to \ Ship-to : Tally.ERP 9 enables multiple addresses for Outward supplies and hence you can configure this functionality which is required under the GST law.

- Branch Transfers : Under GST, Branch Transfers are also taxable and hence you should setup your transaction process to handle these types of transactions.

- Emailing of transactions : ERP 9 enables emailing of Sales Invoices and other transactions. This feature can be put to good use to ensure that your customer gets a copy of the Invoice as soon as you book it…thereby giving them time to revert of any mismatches that may occur.

- Consolidation & Group Companies : Under GST, records need to be kept separately for each location / type of activity. The consolidation feature in Tally.ERP 9 will help you manage multiple locations / divisions and should be implemented.

The big question. How do you ensure that you are filing accurate returns under GST ?

Tally.ERP 9 already has a Triangulation feature what works like an exception reporting system for Returns to be filed. It highlights entries included and excluded in the returns . This makes it easy to ensure that all required entries have been included. Any masters which have not been correctly classified or mapped are also highlighted. It is essential that users familiarize themselves with this key feature so that they can put it to good use once the GST enabled edition launches.

Software@Work I. P. Ltd are conducting regular training sessions on the above topics to help businesses prepare for GST. Please visit www.sawindia.com/blog for more details or call us on 730 30 30000 for any queries.

Upcoming GST Events (Paid): Register Now

Our GST related Services/Offerings:

-

- Tally.ERP 9 GST Edition.

-

- GST Invoicing solution for organisations not having GST compliant software.

-

- GST E- Learning Module for CA Firms.

- GST compliance software for Practicing CA Firms.